2.2 - Michael Kors' eyes on Jimmy Choo

21:59

Hei man, do you think your wife/ girlfriend/daughter spend lots of money to buy one pair of shoes? Well, I'm almost to shock you.

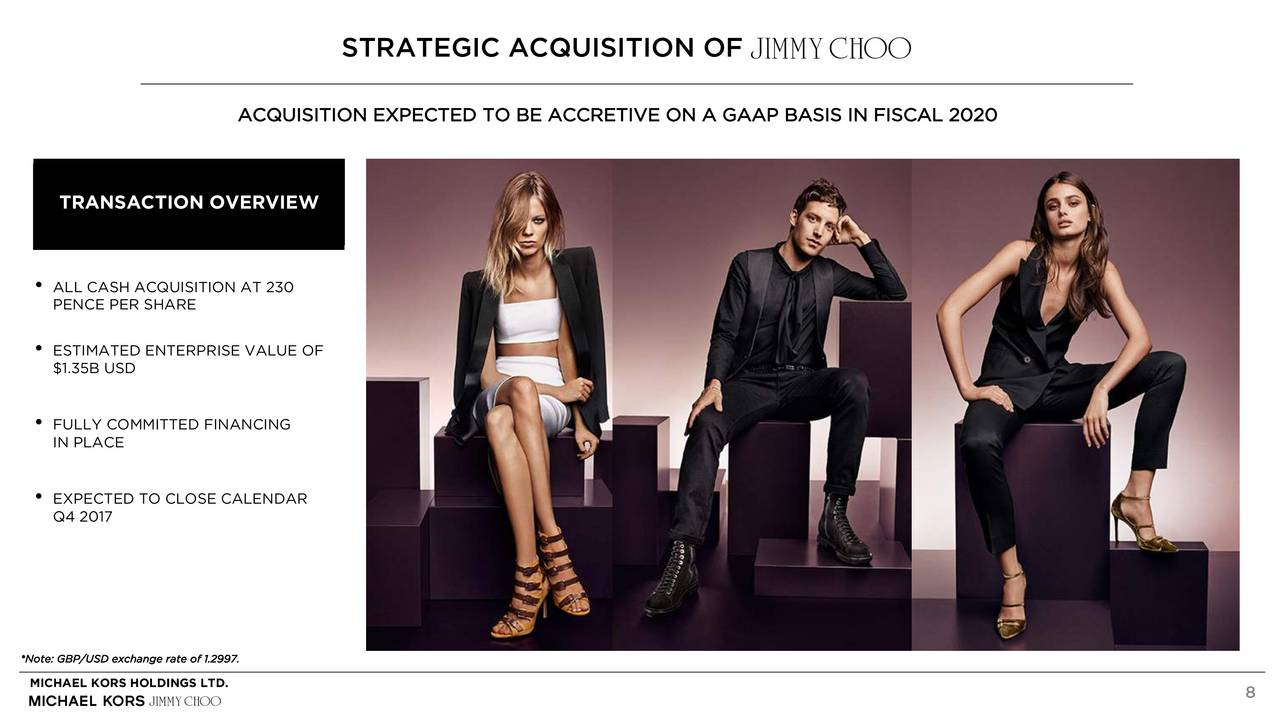

Since last Tuesday the web community has been going crazy for the last "gold" (I'm not using this word by chance) fashion news. Fashion victims, influencers, journalists and business professionals are tweetting on the coming-most-expensive-fashion-acquisition of the year: Michael Kors is buying Jimmy Choo for $1.2 Billion. The global Stock Exchange reacts to the announcement of this acquisition as follows: "shares of Michael Kors edged up 1% in pre-market trading, while shares of Jimmy Choo surged 17% in London" (Forbes).

This deal involves two of the most loved fashion brands by celebrities although they appeal different segments of worldwide population.

MK Holding group is improving its business strategy in combining new shoes with its famous bags so to build a bigger international luxury brand. Its intention to give new pull to the brand justifies its eyes on the fabulous JChoo.

Jimmy Choo, on its side, occupies a higher price range between $425 (Open-toe slip-on sandals) and $3,000 ( crystal-encrusted shoes with the brand’s signature sky-high stilettos). This means different customer targets, ofc, but also hefty profit margins and an upmarket aura. The British brand was put on sale in April and Mr. Kors (here below) wants it!

Mr. Michael Kors himself said:-""We admire the glamorous style and trend-setting nature of Jimmy Choo designs"

Fashion customers traditionally loyal to middle market (finding a balance between style and price) have been satisfied by e-commerce. This have facilitated, on one side, some brands like Amazon, Zara, H&M as well as some top brands such as Gucci. The same exposed some companies, on the other side, such as Michael Kors - "once the runaway leader of the “accessible luxury market”".

Fashion customers traditionally loyal to middle market (finding a balance between style and price) have been satisfied by e-commerce. This have facilitated, on one side, some brands like Amazon, Zara, H&M as well as some top brands such as Gucci. The same exposed some companies, on the other side, such as Michael Kors - "once the runaway leader of the “accessible luxury market”".

Despite the general trend of fashion retailers facing said recent fierce competition by e-commerce, Michael Kors is additionally "in the process of closing 100 to 125 of its standalone stores, renovating another 100-plus stores and doubling down on more innovative designs". (Forbes)

Michael Kors' strategy to build a great American fashion luxury brand seems therefore well matching with the chance by Jimmy Choo.

So far, MK has usually focused on a balance between fashion-forward designs and competitive prices. It invested on outlets and department stores, where deep discounting is common. According to The New York Times Michale Kors needs an update to divert its recent market trend, btw: the one-decade-effects of its charismatic designer and founder ask for new inspirations always based on his motto:

every woman wants to look “pretty and rich.”

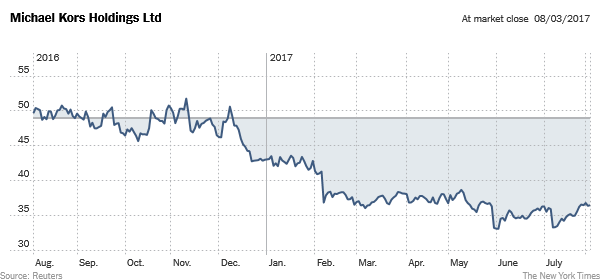

The below table shows how the market trend of this brand has languished since 2011. In particular, it downgraded its sale forecasts for the second half of that year so to close "as many as 125 of its full-price retail stores". In 2017 its share price has lost almost a fifth of its value (now $34,91).

Now things seem changing in favour of MK's plans. Proof of this is the recent strange "battle" between these two brands: meanwhile Jimmy Choo was putting in the market its Molly crushed velvet high heel sandals ($875), Michael Kors answered with its Annaliese leather platform sandals ($140)." Since April (time to sale) Jimmy Choo has tried to avoid the Chinese interest on its assets. At this regard Mr. Pierre Danis, its chief executive officer (with previous executive experience non-other-than for LVMH), said as follows:

“I was afraid it would fall into the hands of a Chinese private equity fund with no experience in luxury and I think John Idol is a successful man who has built a great business with Kors, I think there are a lot of synergies — in bags for Jimmy Choo and shoes for Kors.”

The MK Chief Executive, Mr. Idol, is instead focused on increasing the number of acquisitions involving luxury companies "that “lead in style and trend” but also “have got some size and scale” as well as “some heritage.”" All this to reach the above mentioned MK's goal about a big American fashion luxury brand. Particularly, Mr. Idol said:

“Acquiring Jimmy Choo is the beginning of a strategy that we have for building a luxury group that really is focused on international fashion brands,”

This deal then could represent a great opportunity for MK (1) to enter in the high luxury market, (2) to increase sales and (3) to diversify/ improve this decreasing trend.

Terms&Conditions of this deal should set that Jimmy Choo would maintain its current management (including the chief executive Pierre Denis and its Art Director, Sandra Choi). Reason why Company's board of director support this business transaction by promoting this to shareholders. According to the New York Times, behind the Contracting Parties: Goldman Sachs and J.P. Morgan advised Michael Kors, while Bank of America Merrill Lynch and Citigroup advised Jimmy Choo.

MK forecasts are to open new Jimmy Choo stores and expand its fashion offerings (even online) to reach the goal of $1 billion sales/year. This in an overall perspective increasingly investing in e-commerce and social media, by leaving the new entry independent. MK's top management seems sharing JC's business plan so to promote its further implementation. Moreover, the already mentioned MK's plan to get in fashion luxury under US flag seems considering men's footwear, as well. In this view, thanks to this acquisition MK could get in new markets (in Asia, for example, where Jimmy Choo is already playing its role).

MK forecasts are to open new Jimmy Choo stores and expand its fashion offerings (even online) to reach the goal of $1 billion sales/year. This in an overall perspective increasingly investing in e-commerce and social media, by leaving the new entry independent. MK's top management seems sharing JC's business plan so to promote its further implementation. Moreover, the already mentioned MK's plan to get in fashion luxury under US flag seems considering men's footwear, as well. In this view, thanks to this acquisition MK could get in new markets (in Asia, for example, where Jimmy Choo is already playing its role).

What does this mean to other shoemakers?

Other European luxury groups focused instead on long-term strategies to maintain "an illusion of exclusivity", while their US colleagues have been preferring short-term sales despite the luxury reputation.

The MK strategy well reminds to the one of Coach, rather than to LVMH and Kering, which focuses on true luxury brands. In particular, these last two groups are at a more advanced stage of development by already controlling dozens of brands.Who knows if MK Holding group succeeds in such a "fashionable" run-up?!

Sources:

0 commenti

Please, share your opinion about this post. Follow me on the main Social Networks.